Dear Customers, we have many partner banks around the world. We own payment processor in Latvia and are “an agent of the zero rate” of all major payment systems. Thanks to these advantages, we offer the best conditions in the market. Please, contact us!

We work with the Offshore,

European & Russian companies

We give a preliminary answer

within 24 hours from the time of application

We are able to connect almost

any HIGHRISK businesses

Our rates are lower than that of any domestic bank or payment system

Payments in any currency fall on the bank accounts without conversion (you save 1-2%)

We provide an API to integrate instantly after the pre-approval of your site

We offer three variants of integration: inframe, redirect to payment page and with payment data redirection (needs PCI DSS)

Data about your income is unavailable to the tax authorities in your country (as opposed to the domestic processors)

We serve all types of businesses

We provide means of fighting against fraudulent payments

We work with companies of any states including offshore

Our payment system allows you to connect several methods of payment at once. We connect: VISA, MARTERCARD, DINERS CLUB, PAYPAL, MONEYBROOKERS, QIWI, WEBMONEY, YANDEX etc.

Personal manager

For each client, we provide a personal manager, who is responsible

for ensuring that you receive quality, reliable and convenient service

as quickly as possible. We do not have the words “tomorrow” and “later”,

we do everything NOW!

We provide a wide range of banks

Our processor is integrated with many banks around the world. Ability to open multiple merchant accounts in different countries and currencies allows you to get the best rates and other conditions.

We provide international legal services

Tax planning services and registration of offshore companies allow you to avoid unnecessary taxation and comfortably conduct your Internet business from offshore jurisdictions.

Connection to our system is always free.

Tariffs for connection to acquiring:

| Tariffs for setup of Internet acquiring

in our partners payment systems (connection to our system is always free) |

For sales of virtual goods around the world | For domestic sales of physical goods | For sales

of physical goods in Europe & US |

| Easy connection of the Internet site to partner payment systems or banks • Mass mailing of information on the processors and banks (more than 50 providers) • Search of solutions with a minimal rates • Preparation of outgoing documentation • Negotiation with foreign counterparts • Consultation on system integration |

299 € Internet-acquiring connection |

370 € Internet-acquiring connection |

199 ~ 970 € According to availability of the necessary documentation |

| Aggregated solution for minimizing commission

and taxation with the maximum amount of

payment options • Mass mailing of information on the processors and banks (more than 50 providers) • Designing schemes to minimize taxes (tax planning) • Registration of legal entities (1-4 pcs. depending on the complexity of solution) • Selection of solutions with a minimum commission and maximum list of options • Preparation of outgoing documentation • Negotiating with foreign counterparts • Consultation on system integration |

1770 € One company, account, processor / bank |

~3700 € 2-3 companies, accounts, processor / bank + 999 € Tax planning service (Development of offshore scheme of business) |

2499 € One company, account, processor / bank, complex solution |

| Optional: • Preparation of contracts between companies of the holding and offer agreements to the end customers • Protection of intellectual property rights (domain name, software, etc.) • Obtaining licenses in the countries of business • Opening offshore bank accounts for beneficiaries |

At standard rates or by agreement | ||

Download the complete list of payment solutions

* Tax planning and development of contracts are paid separately* When dealing without prepayment communications take place only via e-mail

* Price may vary depending on the parameters of your business

* All works do not last for more than a month

Acquiring and “Internet acquiring”

Definitions: Acquiring – activities of a financial institution (bank or payment provider) to implement the processing of bank credit or debit cards, which is a sequence of procedures to verify the data entered by the cardholder, debiting his account and charges to the account (merchant account) of the organization of the recipient. Also called the “Merchant Acquiring”.Internet acquiring – implementation by the “Payment Processing Clearinghouse” of a sequence of transactions with cash similar to merchant acquiring, but without the identification of signature of the Cardholder and as a consequence with the consequent possibility of cancellation of payment “on demand” of the Cardholder (chargeback) within 180 days.

Acquiring: rates and factors influencing them

Acquiring is of two kinds: Merchant Acquiring using POS-terminals – when the card is physically present , and its owner puts his signature on the check (payment marker «Card present») and Internet acquiring – when the card is missing and it is impossible to identify the person committing payment (marker «Card not present»). The presence of the marker in electronic banking transaction is the most important element that determines what kind of acquiring, tariffs, rules of treatment and opportunity for appellation and possibility of cancellation of the payment.To protect Cardholders from fraud the possibility of a simplified cancellation (Chargeback) implemented into the payment procedure with marker «Card not present». In many cases, the Cardholder can simply call his bank and tell that the goods have not been delivered or the service has not been provided properly.

In order to minimize cases of “chargebacks” VISA, MasterCard and other card regulators imposed strict sanctions against Merchants, providing poor services, in the form of fines for each case of cancellation of payment. And the Merchants themselves were divided into classes of activities depending on the level of risk of “chargeback”. Tariff scales were established to determine the basic commission depending on the “Merchant class”. Also the maximum permitted levels of “chargebacks” were identified (Maximum chargeback level) – for example, for VISA credit cards it is ~2 %, and for MasterCard ~1%. And the restriction on these percentages the regulators set not for the traders themselves, but for the banks.

In addition, VISA and MasterCard have divided the planet into special zones – “landing” fund from cards of European banks by the American bank will cost more for the recipient than the payment through the European processor or bank. That commission is called «Interchange rate». It is believed that it was created for «market skimming» from Internet businesses that minimize costs through a variety of offshore schemes.

Internet acquiring and “Chargebacks” problem

Hard limit on the percentage of ” chargebacks ” gave rise to two types of payment processing specializing in reducing their number:The first type – that organizations producing reduction of “chargebacks” lawful methods. These companies create telephone customer support centers, conduct audits of sites, logistics and consulting business reorganization. This type of processors is interesting when exceeding the maximum level of “chargebacks” is within 1%.

The second type – this firms specializing in working with high risk businesses with high turnover and the level of returns more than 4% . Working in tandem with the banks, they arrange a “carousel” of shell entities and using delays in processing sequence, they withdraw money from the accounts before the regulator will prohibit transactions and block the withholding percentage. This is “black” acquiring. Rates in these organizations, of course, much higher.

Acquiring services. Connection options.

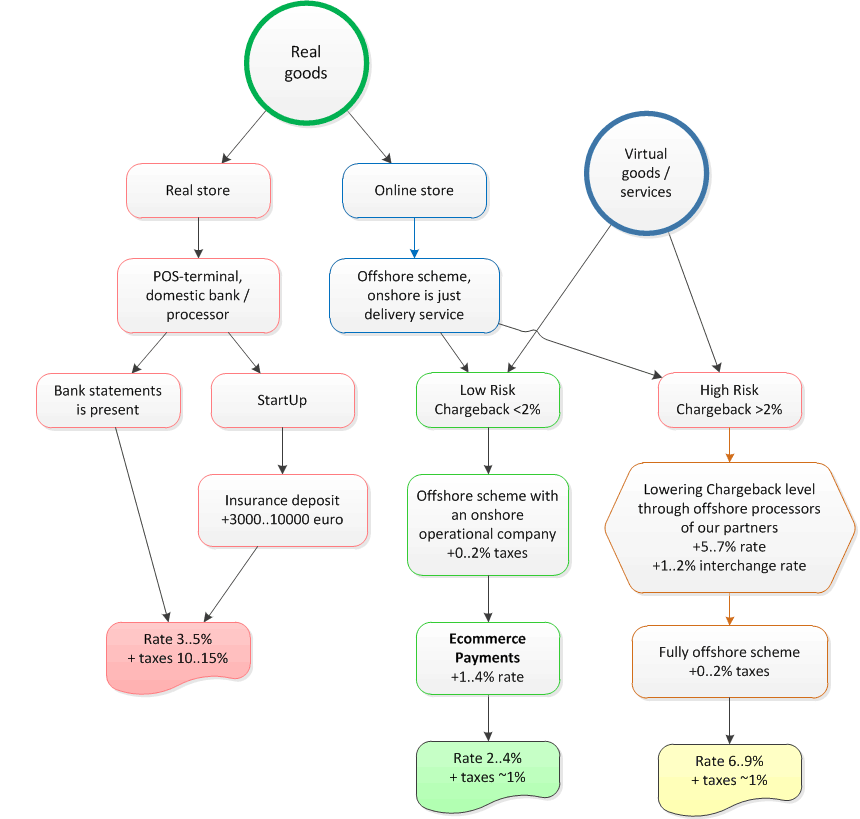

When connecting the acquiring services, the commission by 90% is determined by the level of “risk” of business. Therefore, each processing or the bank in the first place, is interested in the details of business models and payment history if it exists. In addition, for the Internet companies there are ample opportunities for tax planning, as well as a variety of logistics schemes in trade of physical goods. When choosing acquiring scheme, you should always take into the balance between these factors:

Bank-acquiring or processor?

You can read about the difference between using a bank acquiring and processing in the article about the Payment processing. As a summary it can be noted that the conditions and tariffs for acquiring services in banks and payment systems are practically identical. In this case, the fee is determined by the following parameters:

- The degree of riskiness of the business (high, medium, low)

- Monthly volumes, the average amount of the payment, number of payments

- Type of business (goods and services), the stability of the financial indicators

- Jurisdiction of the registration of a legal entity, the age of the company

- Personalities of business owners (citizenship, welfare, etc.)

- Prestigiousness of the bank having opened a usual corporate account

- The quality of the website, the availability of contracts, multi-lingual resource

- Having a business plan and forecast of performance indicators (for start-ups)

- Having a telephone customer service, its quality

- Policy on voluntary refunds of payments (refund policy)

Depending on the answers to these questions, the rates of the payment systems and the banks will vary from 1.7% for typical online stores with a good history to 5-10% for complex startups. Regarding the payment of funds, it would be in the best case the delay of funds withdrawal for 3 days with no additional conditions, and at worst there can be “draconian” conditions of the security deposit of up to 20,000-30,000 dollars with delayed payments of up to 1-2 months.

Acquiring connection. Our services.

Connection conditions and tariffs for acquiring in different organizations may vary vastly. The negotiation process with each payment system takes from 3 days to 2-3 weeks. In our assessment of the world right now, there are about 1300 developed acquiring systems, each of which specializes in certain types of Internet businesses. No matter if you are looking for bank or payment processor (in practical terms, they are the same), it is very difficult to find the best conditions by yourself. For this reason, we offer the following services for our customers:

- Acceptance of card payments at the most competitive rates

- Reorganization of business to work on a tax-free offshore scheme

- Connecting to the partner offshore payment systems

- Selecting the optimal scheme of acquiring for the business model presented

- Selection and negotiation with suitable processors and banks

- Conducting billing servers system integration

- Consultation on how to reduce the number of chargebacks

Additional services:

- Acquiring for «High Risk» businesses

- Creating structures of legal entities for tax optimization

- Creating systems for automatic outgoing payments

- Risk analysis from a legal and tax perspective

- Consultation on the technical side of electronic payments

- Creating your own payment processing companies

- Opening of banks in offshore jurisdictions

Dear Customers, there are no organizations in CIS offering similar services in the field of electronic commerce. If you want to be able to operate effectively in the field of Internet acquiring, please, contact our experts. We are always ready to help you.