Offshore Business

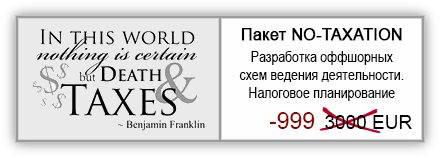

Our company provides services for setting up offshore businesses. By setting up an offshore business, we mean a business structure that addresses one of the following objectives:

• Minimisation of the tax base

• Repatriation of capital from the country of operation

• Ensuring the confidentiality of beneficial owners

• Obtaining low-cost licences for certain types of activities

• Technically convenient ownership of intellectual property rights

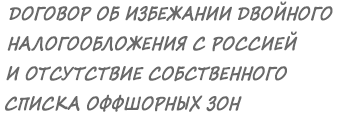

Operating any business in countries such as Russia, Ukraine, Belarus or, for example, Kazakhstan always entails full taxation. Transforming a business into an offshore-international one, however, allows not only to reduce taxes to zero, but also to obtain various personal safety guarantees. Such schemes are especially relevant when part of the activity is conducted online, for example, sales are made through a website. In such cases, the competent inclusion of an offshore company in the chain of legal entities allows trading even in physical goods with the payment of minimal taxes (<1%). In such a situation, the meaningless phrase “offshore business in Russia” begins to fully correspond to the actual processes taking place.

As an illustration of the opportunities provided by moving part of the online business abroad, we present an example of an offshore business scheme developed for one of our clients.

Offshore Business for Operations in Russia

Our client wanted to engage in the supply of consumer goods from Europe. It was proposed that they establish a website and accept orders through a Cypriot company, subject to a 10% corporate tax rate. The profits of the Cypriot company, in turn, were to be transferred to a BVI company as royalties under a licensing agreement for the use of the said website. The British Virgin Islands does not levy taxes on business activities conducted outside its territory. Deliveries of goods to end customers were carried out by mail through a technical logistics company in Latvia, which also operated on a zero-profit basis. Furthermore, the business owners were concealed behind nominee shareholders, rendering their identities inaccessible to Russian state authorities. Thus, our client was presented with a completely legal scheme for conducting tax-free and anonymous trading activities within the Russian Federation.

Business Abroad

Technical Component

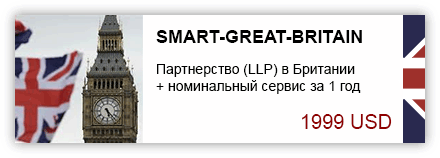

The first stage is the development of a scheme for future operations. Of course, we develop a bespoke international offshore business scheme for each client. However, the set of elements of such schemes is quite typical, these are:

1. Legal entities, forms of ownership, ownership mechanisms

2. Rules for the transfer of shares, nominee service

3. Agreements to transform legal entities into a structure

4. Bank selection considering withdrawal requirements

5. Detailed tax scheme, accounting procedure

6. Provision of payment service providers (internet acquiring)

7. Jurisdictions for obtaining low-cost licences and transfer mechanisms

8. Scheme for obtaining and owning intellectual property rights

9. Website analysis, offer, marketing, sales models for goods and services

The second stage is the actual incorporation of a business abroad. At this stage, we offer our clients the practical implementation of the elements of the created scheme. The client can take over some of the work, we do something ourselves, and some elements are cheaper to outsource.

Outcome

As a result of contacting our company, you receive a full range of the most advanced legal and financial instruments for conducting offshore business. All you have to do is start operating and making a profit.

In addition to launching offshore Internet businesses, for complex IT projects, we also provide external audit services in the field of IT and jurisprudence. We also engage in external management of Internet projects. Contact us.