Offshore schemes

Offshore schemes for online businesses are a crucial component of success. Why is it so complicated and important? There are two reasons: taxes and personal safety.

The fact is that the specific nature of the Internet is such that by registering a company, for example, in Belize, you can place servers there and provide services or trade virtual goods around the world. It would seem that this is an ideal option that allows you to conduct business without paying any taxes. Its implementation is elementary – just contact any organisation dealing with offshore companies and within a couple of hours they will issue you with a legal entity, open a current account and provide directors. But, unfortunately, this scheme will not “work”.

Forgive my candour, but conducting e-commerce through a Russian legal entity is,

to put it mildly, not very sensible.

Alexei Zarin

The Specifics of Doing Business Online

Offshore Operations

“Pitfalls”

Firstly, any Internet business is tied to acquiring, i.e. accepting payments from credit cards. The problem is that VISA and MasterCard almost directly prohibit banks from connecting legal entities from the blacklist of offshore companies. And payment systems either do not work with such companies or charge “draconian” commissions for offshore transactions.

Secondly, the most interesting offshore technologies, such as hiding the names of beneficiaries or truly anonymous bank accounts, work only with the most odious subjects of international law, and it is no coincidence that the vast majority of medium and large companies refuse to deal with these jurisdictions.

Thirdly, placing a server in remote corners of the world is impossible due to poor Internet, and finding “fixed assets” in any other country leads to corresponding legal and tax consequences in that state.

The list of troubles that independent attempts at “tax planning” lead to can be continued for a long time. What is the probability of being arrested when crossing the border of such states as the United States, which believe that taxes should be paid to their treasury from profits received from their citizens, regardless of where the company is registered. Of course, when doing Internet business, such issues become especially relevant.

For these and many other reasons, the development of a high-quality offshore scheme is a prerequisite not only for minimizing the tax base, but also a matter of personal safety for the owners of Internet companies.

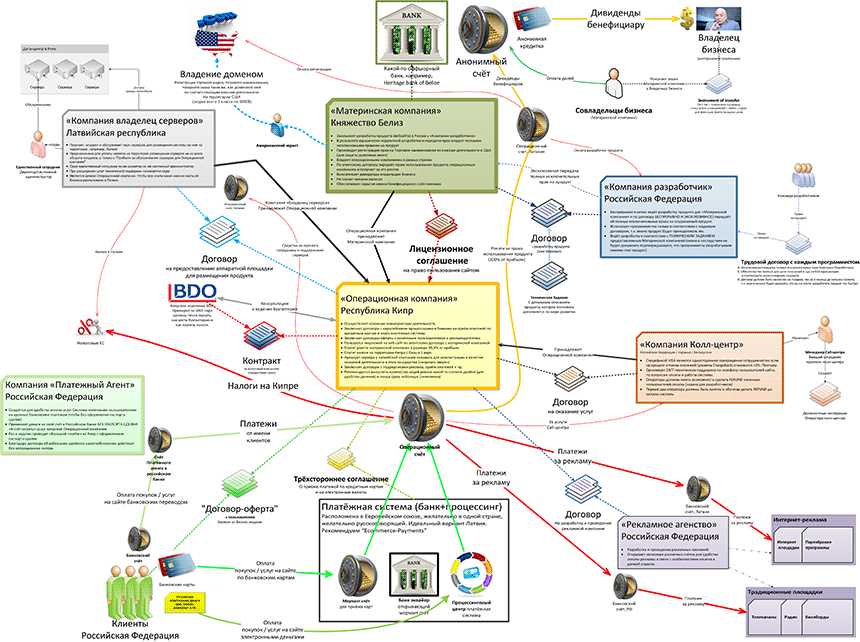

Example of an Offshore Scheme for an Internet Business

The model is legal, tax losses ~1%, the beneficial owner is not identifiable

Proper Offshore Techniques

The correct method, when solving the problems of minimising the tax base in offshore operations, is different. Offshore companies are combined into structures with firms from reputable jurisdictions. Each legal entity in such an offshore scheme is selected and registered to solve one or two problems in the state whose legislation allows them to be solved in the best possible way.

Such offshore technologies require the conclusion of a large number of international agreements for their work. The development of these agreements is in itself a non-trivial task, even for a specialist. In addition, in the process of developing offshore schemes, it is always necessary to take into account the possibilities of tax planning when conducting international activities.

Given the imperfection of legislation in the field of e-commerce and its inconsistency even within such entities as the European Union, the development of a high-quality scheme for conducting activities using specific offshore methods is a task that is best entrusted to professionals.

Our services:

■ Development of tax-free schemes for conducting Internet business

■ Connecting websites to offshore payment systems

■ Legal justification for the withdrawal of financial flows to offshore zones

■ Writing contracts in any language for developed schemes

■ Registration of companies and opening of bank accounts according to the developed scheme

■ Opening accounts in foreign banks for established companies

■ Assessment of risks arising at each stage of doing business

■ Creation of legal entity structures for your business model

■ Technical and legal audit of the work carried out on the project

Key stages of cooperation.

Cost and work procedure.

* The following is the most complete scope of work. Of course, the actual interaction scenario is different each time.

1. During the initial consultation, the client presents their business model, and our consultants offer preliminary options for the project implementation. The client is informed about the possible structure of legal entities, options for financial flows, separate agreements with jurisdictions for dispute resolution are outlined, and issues of licensing and taxation are discussed. The rationale for the proposed solutions is given. The total cost of the project implementation is preliminarily estimated. The price of an hour of initial consultation is 5000 rubles.

2. The second stage is the creation of a detailed project scheme on paper in legal, tax, payment, and IT aspects. As a rule, the result of the work at this stage is one sheet of A1 or A0 format with high detail and several A4 sheets with a phased implementation plan, costs, and deadlines. The development of such a scheme and supporting documents, depending on the complexity, costs from one to ten thousand euros. The timeframe is from one to two to three weeks.

3. If necessary, at the third stage, individual elements of the scheme can be worked out “in depth.” For example, in the case of purchases of traditional medicine somewhere in Malaysia, the specialists of our company may not have accurate information on the rules of accounting and taxation in this state. In this case, to clarify the information, it may be proposed to order the study of these issues from a local audit firm. And from local lawyers, obtain information on the need for licensing with real deadlines and costs “from practitioners.” As a rule, the cost of such work abroad is ten times higher than in the Russian Federation and ranges from 3,000 to 50,000 thousand euros. However, this stage is not mandatory.

4. The last stage is the actual implementation of the project. In accordance with the developed scheme, we carry out the following work for our clients:

• Registration of legal entities

• Obtaining the necessary licenses

• Opening accounts in offshore banks

• Development and support of contracts

• Connecting companies to payment systems

• Registration of trademarks

• Protection of intellectual property

• Other necessary actions to start a business

As a rule, the cost of work at this stage ranges from 5,000 euros for standard trading schemes to several million when launching large international projects.

Dear Sirs,

We are pleased to offer you our full range of services for the implementation of your project.

Should you wish to undertake all legally binding actions independently, we are ready to provide you with an experienced consultant who will accompany you on all trips related to company registration and contract conclusion.

Please do not hesitate to contact us.

Alexey Zarin

Moscow, 2012