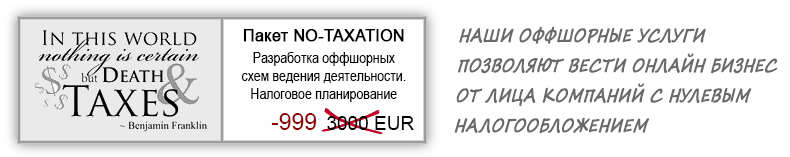

Offshore Payments and Offshore Merchant Accounts

Theoretical Part

Classic credit card processing represents an interaction between a payment card provider (VISA, MasterCard, etc.), the cardholder’s bank (issuer), a processing company (processor), the bank where the payee holds a merchant account (acquirer), and the payee themselves.

Payment card providers decide which payments (for which services) from which countries to which countries are allowed and what fees to charge processing companies. Providers prohibit certain payments they deem risky.

Processors can be “white” or “grey.” White processors typically work only with existing legal businesses, require website compliance with a number of standards, require a security deposit, disclosure of the names of the real business owners, and other specifics for each different type of business.

Opportunities for Using Offshore Companies

One of the most interesting opportunities provided by registering a company in an offshore jurisdiction is the concealment of the identities of the beneficial owners. This opportunity, for obvious reasons, can be particularly appealing to citizens of the Russian Federation. Unfortunately, such schemes are not welcomed by most financial institutions and, in particular, internet companies. If implemented incorrectly, difficulties may arise with accepting electronic payments.

The fact is that obtaining data on business owners is a requirement of VISA and MASTERCARD for banks to open “Merchant” accounts, which, in turn, are needed to accept credit card payments. The second requirement, now from the banks themselves to the companies, is that they have annual financial reporting to the state. Both of these requirements are incompatible with the ability to conceal the true owner of the operating company (the person conducting the business). In these cases, it is necessary to use structures of legal entities.

Example of a Simple Company Structure

A popular example among “real-world” entrepreneurs is the British Virgin Islands – Cyprus structure, where a Cypriot operating company is “openly” owned by a parent company in the BVI. However, the owner of the BVI company remains hidden. It’s important to note that Cyprus is not a classic offshore jurisdiction. It’s a low-tax jurisdiction with a 10% corporate tax rate, and being part of the European Union, it adheres to all its regulations and restrictions. Additionally, Cyprus has limited internet connectivity to the mainland, making it unsuitable for server hosting. Moreover, opening a merchant account, even with a bank, would require disclosing the actual owner of the business. Consequently, the BVI – Cyprus structure is a suitable choice for withdrawing funds to offshore accounts with subsequent liquidation of the structure. However, it might not always be the best option for running a long-term online business. It is worth noting that there are dozens of offshore jurisdictions globally, and depending on the business model, various schemes and combinations can be implemented. The key is to consider the specifics of online entrepreneurship.

Furthermore, it’s crucial to understand that the concept of beneficiary anonymity varies significantly across offshore jurisdictions. In one jurisdiction, the registry might be accessible upon request from any country’s court. In contrast, another jurisdiction might only grant access through a court order from its own judicial system and solely for criminal cases. These represent entirely different levels of protection. Typically, a higher level of protection often translates to greater challenges in negotiating with payment systems. Each case involves finding a balance between security and opportunities, establishing a structure of offshore companies, or providing a security deposit to the payment system. In most cases, a combination of these approaches is employed.

To determine the most suitable strategy for ensuring the security of your beneficiaries, we recommend seeking advice from our specialists.