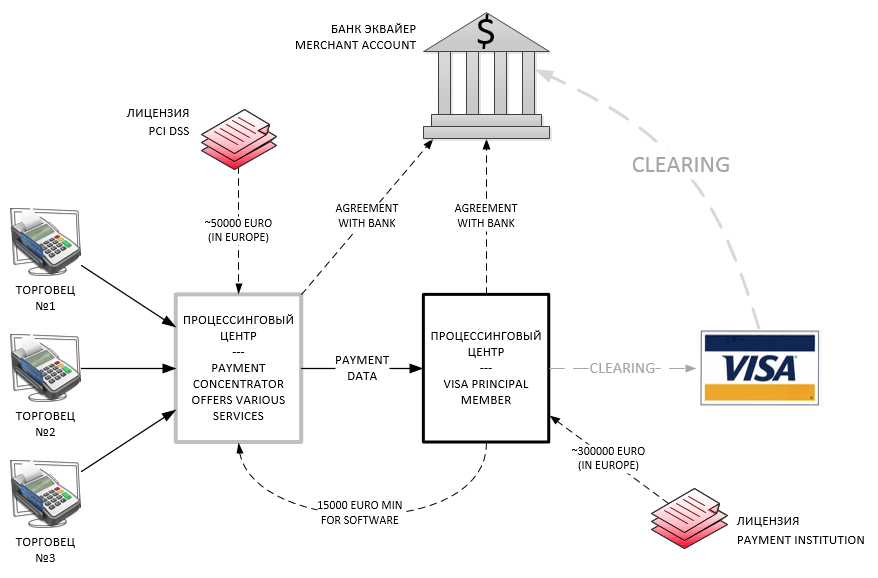

Creating the Payment Processing Clearinghouse

Creating your own Payment Processing Clearinghouse is an expensive project. Creating your own Payment Processing Clearinghouse is divided into several stages, each of which requires the participation of highly qualified specialists in various fields. These stages are as follows:

1. Obtaining a processing license

2. Procurement and integration of encryption modules

3. Arrangements with banks and other Payment Processing Clearinghouses

4. Creation and integration of billing software & servers

5. Organization of the online support of users

6. Marketing, promotion of the product in the market

Our specialists are ready to take organization and conducting of these activities. Your own Payment Processing Clearinghouse Stages of creation

For a better understanding of the complexity of the issue, it makes sense to consider the basic steps of creating Payment Processing Clearinghouse in more detail:1. Obtaining a processing license

As in the case with the creation of banks the situation with obtaining processing licenses deteriorated almost everywhere. Only average official component of the cost of the license in the classic offshore, as well as in Hong Kong, Cyprus, Israel is between 100 and 300 thousand dollars plus the cost of software up to 1000000 dollars. It is important to understand that the “official” component – is the smaller part of the actual costs. Unfortunately, experience shows that, in fact, for various reasons (corruption in commissions for financial control, inadequate legislation requiring to show turnovers even of non-existent so far businesses and other troubles), the real budget for this part is usually 3-5 times more.

2. Procurement of encryption modules

Methods for providing consistent, transactional, and secure transmission of financial data at first glance are solely a matter of being in the field of information technology, which should be solved between the programmers. This is not the case. Unfortunately, different financial institutions use a wide range of internal standards. From basic VPN-connections with authorization to MySQL in the gateways of “black” processors, to the use of hardware encryption modules “RECALL” in large banks worth about 700,000 dollars. Thus, the lawyer leading the negotiations on the terms of cooperation should have a very good understanding of the cost and the technical details of the system integration that the “senior” counterparty offers.

3. Arrangements with banks and other Payment Processors

As you can see the complexity of the negotiations between providers of electronic commerce is associated with the requirement to keep in mind the technical features of the business, but that’s not all. The most important part of the negotiation process is trading fees and commissions, which are also closely tied to mutual legal sanctions and technical methods for their implementation.4. Creation and integration of software complex

This includes the creation of a website for future system, the development of the business logic, the implementation of the billing server, the choice of jurisdiction for servers, their procurement and deployment, balancing and commissioning, development of mobile applications, the beta period and the parallel processes of integration with other payment systems and banks.5. Organization of the online support of users

Is an absolutely essential measure, moreover, the presence of such support is one of the requirements in processing licenses of various states. Support should work at least in English.6. Marketing, promotion of a product in the market

It is not enough to create a product, but you need to sell it. Marketing is the most expensive part of the whole event. Today the situation is such that in all markets there are already some big players who fully satisfy the needs of both end users and vendors or service providers. You will have to buy a place in the market. Fortunately profitability of the business is such that all investments can be quickly returned.